HOME EQUITY CONVERSION MORTGAGE (HECM)

QUESTION: What if I told you that there was a way to pay for

your future long-term care costs without touching any of your life or retirement savings?

Would you want to learn more about it? Ha! I

bet you would!

The Home Equity Conversion Mortgage (HECM) is a terrific way to

fund a life insurance policy with a long-term care accelerated benefit component. This is a brand new option, which at the time of

this publishing, almost no one knows about. And mark my words, this is

going to revolutionize the way we, as a country, collectively finance our

long-term care needs.

PREDICTION: The

financing our country’s immediate long-term care needs for our Baby Boomer population is going to primarily come by way

of Home Equity Conversion Mortgages (HECMs).

What is a HECM?

A HECM is a FHA-insured mortgage for homeowners age 62 or older who have either

paid off their mortgage on their current residence or have “significant” equity

already established. It allows the homeowner to withdraw some of the equity in

their home to fund certain financial necessities like a life insurance policy

with a long-term care component, without spending a penny more than they were

before they obtained the HECM.

I know what you’re thinking, “Are you kidding me?! This is

too good to be true!”

The short answer is nope,

this is not too good to be true. Congress has been

looking for a way to help people finance their long-term care needs because

they know they’re not going to be able to finance the increasing care needs of

the aging "Baby Boomer" population because of an ever decreasing workforce which is creating less tax revenue moving forward with more folks retiring and going on government programs like Medicare and Social Security. In 2009,

the Financial Industry Regulatory Authority (FINRA) changed its position on

HECMs (once thought of as a last resort) to use “Housing Wealth” to fund

longevity needs like future long-term care. FINRA is an independent,

not-for-profit organization authorized by Congress to protect America’s

investors by making sure the securities industry operates fairly and honestly.

“Given pensions are going away and Social Security age

going up, given health care costs are increasing, households are in a bind. The

one asset almost all retirees hold is the house.”

– Dr. Tony Webb,

Boston College Center for Retirement Research

HECM Basics

Ø

Your must be 62 years of age or older to qualify

Ø

The real estate used to secure the HECM must be

your primary residence; This is the address on your Driver’s License and your

Voter Registration;

Ø

You must own the property outright or you must

have paid down a considerable amount on the mortgage; The “rule of thumb” is

you will need to have at least 50% equity in your home;

Ø

No monthly payment is required – EVER!

Ø

No defined term on the loan – it won’t come due

until you pass away;

Ø

You must have the financial resources to

continue to pay ongoing property charges such as property taxes, insurance, and

Homeowner’s Association fees;

Ø

The HECM is FHA-insured so if the mortgage ever goes under water - the government is on the hook for it, not you!

HECM Consumer Safeguards

Ø

Homeowner retains title;

Ø

Homeowner/Estate is entitled to any remaining

equity;

Ø

Homeowner may stay in the home permanently;

Ø

Homeowner is NEVER required to make principal

and interest (P&I) payments;

Ø

Mandatory Third Party Counseling – The FHA funds

housing counseling agencies throughout the country who provide information to

you for free or at a very low cost;

Ø

Growing equity line that cannot be cancelled

HECM Costs

The costs to

secure a HECM are minimal and you can finance most of these costs from the

proceeds of the loan. Financing the costs means you do not have to pay for them

out of your pocket. These costs include the initial FHA Mortgage Insurance

Premium. So let’s look at a generic case study that a local lender

specializing in HECMs provided to me to use as a simple example.

Note: This is just an example used for illustrative purposes. Everyone's case is going to be different based on their unique health and financial condition.

Note: This is just an example used for illustrative purposes. Everyone's case is going to be different based on their unique health and financial condition.

Let’s

assume we have a female named Jane

who is age 65 with the following financial scenario:

Income = $2,000/month

Investments = $144,230

Home Equity = $250,000

No LTC Insurance in

place

Total Value of

Estate = $394,230

Jane’s

Problem

·

Exposed to LTC Risk with No Asset Protection

Plan in Place

·

No Legacy Plan

What Jane

Wants

·

Eliminate her LTC Risk

·

Leave a Legacy for her heirs

-

Question: What Happens If Jane Doesn't Have a Plan In Place To Pay For Her Future Long-Term Care Needs?

Assuming Worst Case Scenario: Nursing Home Placement

Ø

Average

private pay nursing home rate (private room) - $7,000 per month or $84,000

per year;

Ø

Monthly

shortfall - $5,000 per month

Ø

Will

deplete $144,230 nest egg in 2.5 years (or 30 months)

Ø

Heirs

will receive - $0 of her life savings nest egg

Question: What Can We Do To Prevent This Spend Down of Retirement Savings?

Funding Source: Loan Proceeds from the HECM

Ø

Secure FHA-Insured HECM loan

Ø

Elects lump sum distribution option of $70,643

Ø

Elects a $500 per month loan distribution option

Ø

Funds life insurance contract with long-term

care accelerated benefits with single premium payment of $70,683 and $500 per

month for 10 years.

Ø

REMEMBER

- these monies accessed through the HECM are considered loan proceeds and thus

are TAX-FREE.

Net Gain Benefit on Day One with HECM

Jane’s Monthly

Income $2,000

Accelerated Monthly

LTC Benefit (if needed) 9,463

Total Monthly Income

Available 11,463

Less Nursing Home

Costs (7,000)

Net Cash Flow (if

care needed) $4,463

Death Benefit on Day

1 $473,173

So did we accomplish

Jane’s goals with the HECM? I’ll say so! We eliminated her exposure to LTC

risk immediately by eliminating the monthly shortfall which would have depleted

her assets in 30 months AND

we improved her Legacy value by immediately adding a death benefit to her heirs

of $473,173. We did all this AND WE DID

NOT SPEND AN ADDITIONAL DIME OUT OF POCKET outside of maybe a $450 or $500

appraisal fee. So on day one, her kids would receive a TAX-FREE death benefit of $473,173 as opposed to a home worth

$250,000 which, if her kids decided to sell it, the proceeds would be

considered taxable income to them. And remember, on day one, she still has

$179,371 of equity left in the home ($250,000 appraised value less the

initial HECM loan of $70,643).

What about the loan?

What effect does the loan have on all this? Let’s look at this scenario 10

years from now when Jane is 75 years old. The lender used an assumed fixed

interest rate on the HECM of 5.120%. Financing and closing costs of $7,766 were

also assumed which were automatically financed by the HECM. We also assumed

that increases in her income, the cost of a nursing home, and her property

value to increase at an average of 4% per year. Based on these assumptions,

this is how it would look in Year 10.

Jane’s Financial Position

With the HECM In Year 10 at Age 75

Jane’s

Monthly Income $2,960

Accelerated Monthly

LTC Benefit (if needed) 9,463

Total Monthly Income

Available 12,423

Less Nursing Home

Costs (10,362)

Net Cash Flow (if

care needed) $2,061

Death Benefit $473,173

HECM Loan Balance -

Year 10 $221,131

Jane’s Property

Value - Year 10 370,061

Equity in the Home

- Year 10 $148,230

So let’s look at how Jane made out with

and without this HECM 10 years from now. First we’ll compare it assuming she

did not need any care during that time. And secondly, we’ll compare it assuming

she did need care in the final 30 months.

WITHOUT PLANNING

Jane – Age 75

Income = $2,960/month

Investments = $213,496

Home Equity = $372,708

No LTC Insurance in Place

Total Estate Value =

$586,204

WITH PLANNING

Jane

– Age 75

Income

if sick = $12,423/month

Investments

= $213,496

Home

Equity = $148,230

LTC

Plan in Place = Peace of Mind

Tax

Free Death Benefit = $473,173

Total Estate Value = $834,899

Again, Jane fared pretty well by adding the HECM. Even

though she did not need nor use the benefit of the accelerated long-term care

benefits, she still increased the value of her estate by $248,695 ($834,899

with HECM compared to $586,204 without HECM). And this doesn’t even consider

the fact that the death benefit will be passed on to her heirs TAX-FREE. AGAIN, NO REQUIRED MONTHLY PAYMENTS AND SHE

JUST INCREASED THE VALUE OF HER ESTATE BY NEARLY $250,000!

-

WITHOUT PLANNING

Jane – Age 75

Income = $2,960/month

Investments = $0

Home Equity = $372,708

No LTC Insurance in Place

Total Estate Value =

$372,708

WITH PLANNING

Jane – Age 75

Income if sick = $12,423/month

Investments = $213,496

Home Equity = $148,230

LTC Plan in Place = Peace of Mind

Tax Free Death Benefit = $189,283

Total

Estate Value = $551,009

So the worst possible situation has happened and Jane needs

skilled nursing care for two and a half years or 30 months. How does she fare

when all the worst possible things happen? Even after requiring 30 months of

care in the an expensive private pay nursing home, the HECM with life and

accelerated long-term care benefits STILL

INCREASED THE VALUE OF HER ESTATE BY $178,301!

The other benefit that we have not even talked about here

is that through the HECM, you will have access to cash through a line of credit

established at closing whereby this line of credit will grow as the value of

your house increases over time.

I think now you can clearly see and understand the

tremendous value and suitability of a HECM to fund your future long-term care

needs and how it can protect your family from not only bearing the

responsibility of being your caregiver, but also, how it effectively protects

the value of the estate you leave behind to your loved ones. And once again, it

bears repeating: THERE ARE NO REQUIRED

MONTHLY PAYMENTS FOR THIS COVERAGE...EVER! What more could you ask for?

WHEN SHOULD YOU CONSIDER A HECM?

IF YOU ARE 62 YEARS OF AGE OR OLDER....

THE TIME TO ACT IS NOW!

WHY?

Because you must be “insurable” to take full advantage of the Life Insurance with Long-Term Care Rider Protection!

ARE YOU INTERESTED?

WANT TO LEARN MORE?

LET'S WORK TO KEEP YOUR SPOUSE AND YOUR KIDS ---- YOUR SPOUSE AND YOUR KIDS ---- AND NOT YOUR CAREGIVER!

I CAN HELP YOU SET THIS UP AND STREAMLINE THE PROCESS FOR YOU AND YOUR FAMILY!

For a personal and confidential consultation contact:

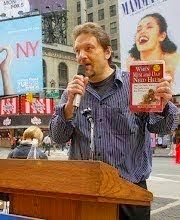

Mike Campbell, CLTC

Licensed Agent

Certified HECM Specialist

(440) 487-6715

mike_campbell@roadrunner.com