It’s hard to imagine our parents as less than self-sufficient. Sitting down and talking with them about their future long-term care needs is an even more agonizing thought. Let’s face it; most of us would rather bury our heads in the sand than discuss this subject with our parents. When a difficult situation like this arises, I’m reminded of the TV commercial that depicts a man in overalls expressing his displeasure at dealing with a car salesman by bellowing, in a Southern drawl, “I’d rather be pecked to death by a duck!” When it came to approaching my mom about her future senior housing and care needs, this was my sentiment exactly!

It’s hard to imagine our parents as less than self-sufficient. Sitting down and talking with them about their future long-term care needs is an even more agonizing thought. Let’s face it; most of us would rather bury our heads in the sand than discuss this subject with our parents. When a difficult situation like this arises, I’m reminded of the TV commercial that depicts a man in overalls expressing his displeasure at dealing with a car salesman by bellowing, in a Southern drawl, “I’d rather be pecked to death by a duck!” When it came to approaching my mom about her future senior housing and care needs, this was my sentiment exactly!It’s time for a reality check, folks. Based on discussions with hundreds of adult children who’ve gone through this ordeal, talking openly with your parents about their needs for long-term care, and planning for the inevitable before it becomes absolutely necessary, is much better than dealing with it on your own later. Helping your parents prepare for their future housing and care needs will go a long way toward eliminating any future guilt. The secret is in getting started. The small amount of pain you experience talking about it now will go a long way toward eliminating the pain and guilt you’ll experience later if you don’t.

You’ve undoubtedly thought: I never want to be a burden to my children when the time comes that I need care. Well, your parents feel exactly the same way. Research has proven that this is so. The time to talk with your parents about their future housing and care needs is now, while they’re in reasonably good physical and mental health. All of your parents’ children should be involved in the discussion. Decisions reached as a group are vitally important because the decision will not only affect your parents, but also each member of the family. Group decisions are more likely to be successful than unilateral decisions. Even if some of your siblings can’t attend a meeting, keep them informed of any decisions made, preferably in writing. It would be unfortunate if one of your siblings were unaware of your parents’ wishes for housing and care, later resulting in a disagreement over what your parents’ wishes really were. Obviously, the final decision is going to reside with your parents as long as they’re mentally capable. If your parents are still capable of being involved in the decision-making, their participation makes the entire process much easier.

A wise man once said, “Every battle is won before it’s fought.” This could not be more applicable than with senior housing and care planning. Let me give you an example. Last year, my friend’s mother died suddenly. Her father had developed Alzheimer’s disease about four years ago and was requiring assistance with several activities of daily living. Her mother was caring for, and tending to her husband’s needs from their home of fifty years. When her mother suddenly died, she and her brother could not agree on what type of housing and care would be best for their dad. It was a very unpleasant experience for both her and her brother. The “guilt factor” was something that played on both of their minds. She told me that she wished they could have sat down earlier with their dad before he developed Alzheimer’s disease and discussed what his wishes would have been in this situation. It would’ve made the decision to move him into an Alzheimer’s/dementia care community a much easier one.

How do I Broach the Subject?

I’ll give you four great tips to having “The Talk” with your parents:

1. Be honest and direct with your parents - Ask your parents’ permission to discuss the topic with them. A couple of good examples to open with: “I’d like to talk with you about how you’d like to be cared for if you got really sick and were unable to care for yourself anymore. Is that okay?” Or, “If you ever got really sick, I’d be afraid of not knowing what kind of care you’d prefer. Could we talk about this now? I’d feel better if we did.”

2. Be a good listener – As my grandmother used to say, “God gave us two ears and one mouth for a reason.” Hear what your parents are saying without interrupting, giving your opinion, or telling them what to do. Rather than offer advice, let them work things out for themselves as they talk. As a good listener, you can help your parents explore their situation by asking them open-ended, non-threatening questions like “What specifically concerns you about moving into a retirement community Mom?” or “How do you feel about this Dad?”

3. Take advantage of opportunities that may arise to help break the ice - For example, a perfect opportunity to discuss your parents’ future housing and care needs would be when one of their friends or family members suffers a traumatic event that requires them to consider senior housing, care or assistance. Bring up some “What if?” scenarios: What if Mom couldn’t get up and down the stairs anymore like Mrs. Smith? What if Dad couldn’t drive anymore like Mr. Jones? What if both of you suddenly needed help with certain activities of daily living? What would your wishes be if you could no longer live at home without assistance? Are you aware of the different housing and care options? Have you thought about how you’ll pay for such housing and care? Tell your parents how much you love them and how you’re willing to work with them together to find answers to these tough questions.

4. Never make promises – This is probably the most important tip of all! Never make promises to your parents such as “We’ll never put you in a nursing home” or “You can always come and live with us, we’ll take care of you.” Circumstances change over time, and what may seem like the best solution now may not be the best solution years from now. Unfulfilled promises can only result in extreme guilt, anxiety, and pain.

Remember---The open communication you have with your parents today will be the “key” to your caregiving experience tomorrow. This initial communication is the all-important first step that will allow you the freedom to have further conversations with parents about the subject; and, these initial conversations will hopefully result in both of you researching and developing your own individual plans for handling those future long-term care needs.

How am I going to pay for my future long-term care needs?

One of the concerns we all have is how in the world we’re going to pay for our future long-term care needs. Qualifying financially is probably going to be the single biggest obstacle for most families. Most people still think their regular health insurance or Medicare is going to cover the cost of their long-term care. This is just not the case. Neither of these covers long-term care. Today, to get the care they need, most seniors have no option but to spend down their hard-earned retirement savings to near zero and then turn to the state and federally funded Medicaid program for assistance. The problem with this is, once you start depending on the government to pay for your housing and care needs, you lose the freedom to decide where you’ll be housed and cared for.

Not only does this affect your parent’s financial condition, it may affect your own. It is estimated that over 40% of adult children caring for their aging parents are providing them with some degree of financial support. Adult child caregivers are spending their retirement savings and vacation funds to help Mom and Dad get the quality care they need.

This is precisely why I believe, looking forward, private long-term care insurance MUST play a vital role in funding the care for our growing aging population. If you have the financial means, I would highly recommend you invest in a private, long-term care insurance policy. Long-term care insurance gives you the financial freedom to choose from a lot more housing and care options that you would otherwise not be able to afford without it. It’s a valuable investment that brings long-term prosperity by preserving your assets and protecting you and your spouse from impoverishment should one or both of you require long-term care. If you can afford it, do your part, and leave the dollars allocated to the state and federally funded Medicaid program to the lower-income Americans who really need it.

We Need to Transition from “Caregiver 911” to “Caregiver 101”

We, as a nation, need to transition ourselves from a “Caregiver 911” scenario to a “Caregiver 101” scenario. It seems ‘the formula’ these days is to wait until we, or our parents, suffer some traumatic event, or “wake-up call”, that leaves us very little time to make some very important and gut-wrenching decisions. As our parents lie in a hospital bed, recovering from whatever led them to needing long-term care, we typically end up running around, as if our hair was on fire, trying to desperately find a quality care option that will meet Mom or Dad’s needs--- yet we really don’t know where to begin or what to look for! Sound like fun? No? Then let’s do something about it! We all need to educate ourselves about the process now before Mom and Dad need help.

Help Me Spread the Word!

My life’s mission is to inspire everyone to open up and have these tough conversations with their parents today. In fact, I suggest these conversations be conducted across all generations (i.e., you should have these talks with your children as well). Let’s all do our civic duty and spread the word to anyone who will listen. Tell people you care about! Tell people you don’t care about! Everyone needs to know about what lies ahead and what steps can be taken to make this process as painless as possible. Open communication is extremely vital to planning for the future.

We all can become the best care advocate for our loved ones by:

1. Talking with our loved ones today about their future care needs while they are still healthy;

2. Educating ourselves about all the long-term care options available in the market; and

3. Making sure we have a sound financial plan to pay for such care.

===================================================

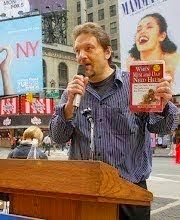

Mike Campbell is the author of a new book called "When Mom and Dad Need Help" (May 2010) which helps the adult child work together with the aging parent to begin planning the very best solution to senior care. Mike has been an advisor to the senior housing and care industry for over 18 years. Campbell now wants to share the knowledge he’s gained over the years and become a dedicated consumer advocate for those families looking to find quality long-term care options for their loved ones by educating them and giving them a plan. For more on the author and how to order the book, go to http://www.iffenwen.com/.