- Reduces the prescription Medicare "donut hole" for our seniors - I know what you're thinking: "What is this donut hole that everybody has been talking about? Everybody loves donuts, right? So what's the problem?" Well this donut isn't covered with sprinkles. In fact, its costing our seniors a bundle. The donut hole, or coverage gap, is one of the most controversial parts of the Medicare Part D prescription drug benefit and is a major concern for many seniors who've joined the Part D drug plan. Let me break it down financially so you can get a better understanding: In 2010, the donut hole or coverage gap starts after the senior's prescription drug costs, including their own deductibles ($310) and co-pays (25%), reach $2,830. After the senior reaches this threshold, they are in the donut hole and must pay the full cost of their prescription drugs until their total out-of-pocket costs reach $4,550. At this point, the catastrophic coverage kicks in and Medicare once again begins covering their costs (with a 25% co-pay). The new healthcare law provides seniors who fall in the donut hole in 2010 with a $250 rebate. Beginning in 2011, seniors will receive a 50% discount on prescription drugs when they fall into the donut hole, and by 2020, the donut hole will be completed eliminated.

- Increased Medicare coverage for preventive services - In 2011, seniors will not have to pay co-pays for annual checkups or other preventive visits including mammograms and colonoscopies.

- The enactment of the CLASS Act helps seniors pay for long-term care services - The CLASS Act is a public, voluntary long-term care insurance program that will help seniors pay for home- and community-based services. Enrolled individuals who need assistance with activities of daily living would be eligible to receive at least $50 a day (after a five-year vesting period) to be used to defray the costs for such services as home care, family caregiver support, adult day services and various other care options. All actively working adults over age 18 can enroll, with the purpose of getting the largest risk pool possible. The law requires that in order to qualify for benefits, one must pay premiums for 5 years and must be working for at least three of those five years. The law also requires that the CLASS Act program (i) be actuarially sound, (ii) not be funded by taxes with all benefits paid from premiums collected by participants in the program, and (iii) anyone who is working can enroll in the program regardless of their health history including any preexisting condition.

- The enactment of the Nursing Home Transparency and Improvement Act - This act requires nursing homes to publicly disclose a wide array of information to consumers like staffing ratios, so families can make informed decisions about where to place their loved ones. This act helps increase the transparency and accountability of our nation's nursing homes.

- The enactment of the Elder Justice Act - This act is considered by many to be the most comprehensive legislation to combat the abuse, neglect and exploitation of our elderly population. It requires the reporting of neglect and abuse in long-term care facilities. This legislation will provide crucial help for a problem that will undoubtedly become more prevalent as our baby boomers grow older.

- The enactment of the Patient Safety and Abuse Prevention Act - This act provides for a national program of criminal background checks on workers who provide long-term care services in facilities and private homes. The program would add a federal component to the background check process by screening applicants against the FBI's national database of criminal history records. This will help prevent applicants with a history of substantial abuse or a violent criminal record from obtaining jobs serving our aging population.

- Federal grants to be provided for enhanced geriatric training - The shortage of properly trained direct care staff for our seniors has been a problem for many years now. This has prevented many of our seniors from receiving the quality care they deserve. Better training means better care for our seniors in a variety of settings.

- Encourages doctors to coordinate care and improve quality - The healthcare law creates new incentives for providers to work together to better serve their patients and eliminate repetitive and wasteful care.

- Bring savings to Medicare by eliminating wasteful overpayments to Medicare Advantage Plans - This is where the "cuts" in Medicare take place. This is the part of the healthcare law that made our seniors very "uneasy." It shouldn't make them nervous at all. Let me explain why by providing a little history. Medicare Advantage plans were created with the passage of the Balanced Budget Act of 1997. The Balanced Budget Act of 1997 enabled Medicare beneficiaries to receive a portion of their coverage from private health insurers. These plans were created in an effort to cut costs, at first, by allowing seniors to enroll in privately run managed care systems, like HMOs, which was, at the time, the big new answer in the private sector to cutting healthcare costs. Initially, Congress offered private insurance companies a bit less than the average Medicare patient received on a per year basis. Insurance companies offered free perks like free gym memberships to attract younger, healthier, cheaper-to-insure patients. They saved money too by offering cheaper preventive care and using their size and bargaining power (just like big HMOs do) to obtain cheaper medical care from providers. The circumstances certainly have changed over the past decade. Medicare Advantage plans have transformed themselves from a cheaper-than-regular Medicare cost savings plan to a 14% more-than-regular Medicare boondoggle. It's been popular with seniors, of course, because they like the free gym memberships and the way they cover their prescription drug co-pays, but it is costing us all an extra 14% more than it would cost to cover them under the regular fee-for-service Medicare plan. All of that 14%, and a bit more, has gone to pay for insurance company bureaucratic overhead and profits, including money for lobbyists to contribute to Congresspersons who, in turn, vote to allocate more federal funds to Medicare Advantage. It's become a win for healthy seniors, a win for the insurance industry, but a big loser for the American taxpayer. The new healthcare law cuts this 14% subsidy to Medicare Advantage plans so the insurance companies that run these plans will either have to get back to where they started, and use managed-care principles to save money, or get out of the business.

The new healthcare legislation is not going to meet every American's wants and needs. Most bills that make it to the President's desk don't. For example, the CLASS Act's $50 per day benefit will only cover a small portion of the $75,000+ annual costs most Americans pay right now for in-home care. Obviously, people who want to protect their savings will need to purchase private long-term care insurance to supplement their CLASS Act benefit. In fact, I believe that personal responsibility and private long-term care insurance must play a major role in order for America to survive the even more looming budget crisis that lies ahead with 78 million baby boomers entering retirement age this year. Think about the numbers. Again, how in the world are we going to care for all these people?

As is the case with many bills that are signed into law these days, you'll find a lot of "pork" and "handouts" in it, which is extremely frustrating; however, as you can see from the list above, there are a lot of positives in the new law as well. The Patient Protection and Affordable Care Act is not perfect but it does make progress. Let's just say the law is an important first step toward meeting the tremendous future needs of our growing aging population. The new law has enacted legislation to better serve and protect our senior population from abuse as well as enact programs that are estimated to extend the solvency of the Medicare Trust Fund by 9 years to 2026. This is a start...but more must be done.

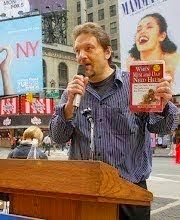

Mike Campbell is the author of a new book called "When Mom and Dad Need Help" which will be officially released in May 2010. For more info on him and his new book, go to www.iffenwen.com.