Even as a young girl who had just awakened from a crazy dream, Dorothy of The Wizard of Oz knew - “There’s no place like home.” Our homes are where we find warmth, security and the comfort of familiar surroundings. While today’s seniors are fortunate to have so many housing and care options available to them, for some, nothing will ever equal living in the home they've been living in for many years. While senior communities and assisted living facilities are perfect choices for some seniors, other prefer to remain in their own homes when facing the challenges of aging and illness. The problem with the latter being a viable option is that, in many cases, people are not able to stay in their homes because they are physically unsupportive environments that lack the necessary design features to ensure safety and accessibility.

Even as a young girl who had just awakened from a crazy dream, Dorothy of The Wizard of Oz knew - “There’s no place like home.” Our homes are where we find warmth, security and the comfort of familiar surroundings. While today’s seniors are fortunate to have so many housing and care options available to them, for some, nothing will ever equal living in the home they've been living in for many years. While senior communities and assisted living facilities are perfect choices for some seniors, other prefer to remain in their own homes when facing the challenges of aging and illness. The problem with the latter being a viable option is that, in many cases, people are not able to stay in their homes because they are physically unsupportive environments that lack the necessary design features to ensure safety and accessibility.It is for this reason, that many baby boomers and beyond are beginning to plan and incorporate various home modifications into their homes. Many are making modifications to their homes so that as they grow older, it will allow them to function independently and safely in their homes for a longer period of time. How well and long you live in your current home will really depend on how well you adapt and remodel it now.

"The art of life is a constant readjustment to our surroundings." ~ K. Okakaura

When you start to consider a home modification plan, there are three main areas of improvement you should consider to make your home a safer environment: (i) Safety, (ii) Lighting, and (iii) Accessibility.

Safety Modifications

By far, the biggest concern for seniors is falling down. Nine out of ten broken hips are the result of falls; therefore, implementing safety and prevention measures are a must. After all, a broken hip usually buys you a first-class ticket to the nursing home which results in the immediate loss of your independence. Modifications made to prevent falls are easy and probably the most important ones you can make. Some of these are listed below.

- Replace all bathroom tubs with shower stalls complete with molded or pull-down seats because nothing is more dangerous than trying to get in and out of a slippery tub. The shower stall floor should incorporate non-skid strips or slip-resistant tiles for fall prevention;

- Install grab bars in the shower stalls; you may even consider a floor-to-ceiling safety pole in the shower stall for additional safety and ease of use;

- Install hand-held showerhead;

- Install grab bars around all toilet areas;

- Install raised toilet seats making it easier for an aging adult to get on and off the toilet;

- Install handrails on both sides of the stairs for better support;

- Consider installing floor-to-ceiling support poles near beds, favorite chairs and toilets to help ease transfer on and off;

- Replace carpeting and tile flooring with non-slip/skid type flooring. They should be tight and firm to walk on, helping to prevent falls and providing ing an easy walking environment;

- Install non-skid rubber strips on the edge of stairs to help prevent falls, Carpet-free stairs are typically safer;

- If possible, eliminate all stairs from your home’s design;

- Install anti-scald devices on faucets and showerheads;

- Review accessibility of electrical outlets to reduce the need for dangerous extension cords.

As we get older, we need two to three times more light than we needed when we were younger. Proper lighting and visibility is also an important safety measure as well to help prevent falls. Here are some ideas to help improve lighting and visibility in your home:

- Review your home’s lighting to make sure you have sufficient, even lighting throughout and add additional lighting, if needed;

- Review and assess the placement of all of your light switches. Make sure light switches are located close to room entrances and at the top and bottom of stairways;

- Install lighted switch plates so you’ll always be able to easily locate the switch at night;

- Install lights inside closets and cabinets;

- Install under-cabinet lighting in the kitchen;

- Install motion-sensor exterior lighting;

- Make sure you use high watt light bulbs in stairways and other hazardous areas;

- Consider installing design features that increase the amount of natural light in your home. Research has proven that daily exposure to natural light can support and nurture a person’s health and well-being. This can be accomplished by adding a skylight, more windows, or maybe converting one of your first floor rooms into a sun room?

Accessibility Modifications

These are design considerations that will help improve accessibility and make your home easier to live in as you age in place.

- Locate countertops, cabinets and shelving to lower heights for easier access. As we grow older, these lower levels willth make things easier to reach as our mobility, balance, reach and range of motion declines;

- Convert kitchen cabinets into drawers to hold pots and pans for easier access;

- Replace door knobs with lever handles. As we age, it is much easier to operate a lever than a door knob;

- Install lever-handle faucets in kitchen and bathrooms;

- Locate windows at lower levels so you can see the ground from a couch, chair or bed. Why not enjoy the view of the outdoors while seated?

- Consider increasing door opening sizes from the basic 29 to 30 inches to as much as 36 to 42 inches to allow a wheelchair to freely navigate the home. The installation of pocket doors to replace regular doors may give you the width you desire;

- Install a permanent or portable wheelchair ramp;

- Install a stair chair lift.

While the following are just a few ideas and modifications that can help you remain independent and in your home for a longer period of time, there are so many others that will be specific to your home and needs. Once you have begun your plan you should contact a home modification specialist who can give you many more aesthetic and functional ideas to accommodate your person needs.

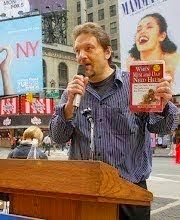

Mike Campbell is the author of a new book called "When Mom and Dad Need Help" (May 2010) which helps the adult child work together with the aging parent to begin planning the very best solution to senior care. Mike has been an advisor to the senior housing and care industry for over 18 years. Campbell now wants to share the knowledge he’s gained over the years and become a dedicated consumer advocate for those families looking to find quality long-term care options for their loved ones by educating them and giving them a plan. For more on the author and how to order the book, go to http://www.iffenwen.com/. You can order the book toll-free at 1.800.345.6665. The book is also available on Amazon.com.